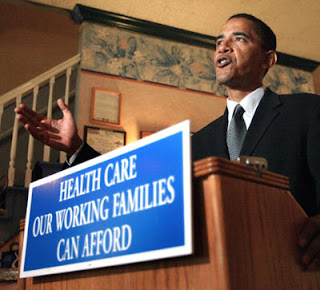

Another Attack on the Affordable Care Act

South Carolina Republican Senator Jim DeMint, the GOP and insurance company lobbyists, are attempting another strategy to prohibit the 'Affordable Care Act' from becoming reality. Republicans re-branded the reform as government run health care and created a website containing patient's rights, as well as frightening videos of the victims telling their horrid stories about the new health care law.

Senator DeMint commented, "If we're able to stop Obama on this it will be his waterloo. It will break him."

Senator DeMint commented, "If we're able to stop Obama on this it will be his waterloo. It will break him."

Senator DeMint commented, "If we're able to stop Obama on this it will be his waterloo. It will break him."

Senator DeMint commented, "If we're able to stop Obama on this it will be his waterloo. It will break him." It would seem that the Republican party is more interested in "breaking" President Obama, than actually doing something that works for the American people. Why must everything be a game of war with them?

Obama is simply replicating the same service that Massachusetts, already has in place for its constituents -- which proved to work amazingly well. If the majority of American people believe health care reform is necessary, why wouldn't the president be wise to listen to the very people he serves? Notable insurance giant AARP even endorsed the new health care cause.

Republicans were adamantly arguing about where funds for the program will come from; but Obama raising billions of dollars already proves that he's committed to making this new law work.

See below President Obama's health care proposal. Does it work for you? Does it not work for you? Why?

Who's covered: 94 percent of non-elderly residents (those not covered by Medicare, which kicks in at age 65) would be covered, compared to 81 percent today.

Nearly half of 17 million non-elderly residents who remain uninsured would be illegal immigrants. COST - about 1.5 trillion over 10 years.

Who's paying for it: 544 billion from a new income tax surcharge on single people making 280,000 a year and households making 350,000 and above; 37 billion in other tax adjustments. 500 billion in cuts to Medicare and Medicaid. 200 billion from penalties paid by individuals and employers who don't obtain coverage.

Individual requirements: you must have insurance enforced through tax penalty with hardship waivers. The penalty is 2.5 percent of your income.

Employer requirements: employers must provide insurance to their employees, or pay an 8 percent payroll penalty. Companies with payroll under 250,000 annually are exempt.

Subsidies: individuals and families with an annual income up to 400 percent of the poverty level (88,000 for a family of 4) would get sliding scale subsidies to help them buy coverage. The subsidies would begin in 2013.

Nearly half of 17 million non-elderly residents who remain uninsured would be illegal immigrants. COST - about 1.5 trillion over 10 years.

Who's paying for it: 544 billion from a new income tax surcharge on single people making 280,000 a year and households making 350,000 and above; 37 billion in other tax adjustments. 500 billion in cuts to Medicare and Medicaid. 200 billion from penalties paid by individuals and employers who don't obtain coverage.

Individual requirements: you must have insurance enforced through tax penalty with hardship waivers. The penalty is 2.5 percent of your income.

Employer requirements: employers must provide insurance to their employees, or pay an 8 percent payroll penalty. Companies with payroll under 250,000 annually are exempt.

Subsidies: individuals and families with an annual income up to 400 percent of the poverty level (88,000 for a family of 4) would get sliding scale subsidies to help them buy coverage. The subsidies would begin in 2013.

How do you choose your new health care plan: through a new Health Insurance Exchange open to individuals and, initially, small employers; it could be expanded to large employers over time. States could opt to operate their own exchanges in place of the national exchange if they follow federal rules.

Benefit package: A committee recommends an "essential benefits package" including preventive services, mental health services, oral heath and vision for children; out-of- pocket costs are capped. The new benefit package would be the basic benefit package, and over time would become the minimum quality standard for employer plans. Insurers wouldn't be able to deny coverage based on preexisting conditions.

Government run plan: the secretary of Health and Human Services, will run a new public plan available to the insurance exchanges which covers Medicare rates in which physicians would attain 5 percent.

Changes to Medicaid: in 2013 the federal state insurance program for the poor would expand to cover all non-elderly individuals, with incomes up to 133 percent of the federal poverty level (14,404).

Benefit package: A committee recommends an "essential benefits package" including preventive services, mental health services, oral heath and vision for children; out-of- pocket costs are capped. The new benefit package would be the basic benefit package, and over time would become the minimum quality standard for employer plans. Insurers wouldn't be able to deny coverage based on preexisting conditions.

Government run plan: the secretary of Health and Human Services, will run a new public plan available to the insurance exchanges which covers Medicare rates in which physicians would attain 5 percent.

Changes to Medicaid: in 2013 the federal state insurance program for the poor would expand to cover all non-elderly individuals, with incomes up to 133 percent of the federal poverty level (14,404).

Comments

Post a Comment

THANKS FOR FEEDBACK!